Money_Finance

Should a Family Budget be Mandatory?

Individual/Family members spending plans, or budgets, are tools that can help you satisfy your financial goals. The process of building a budget can assist you to take a tough take a look at your concerns as well as to identify whether you’re on track to reaching your monetary objectives.

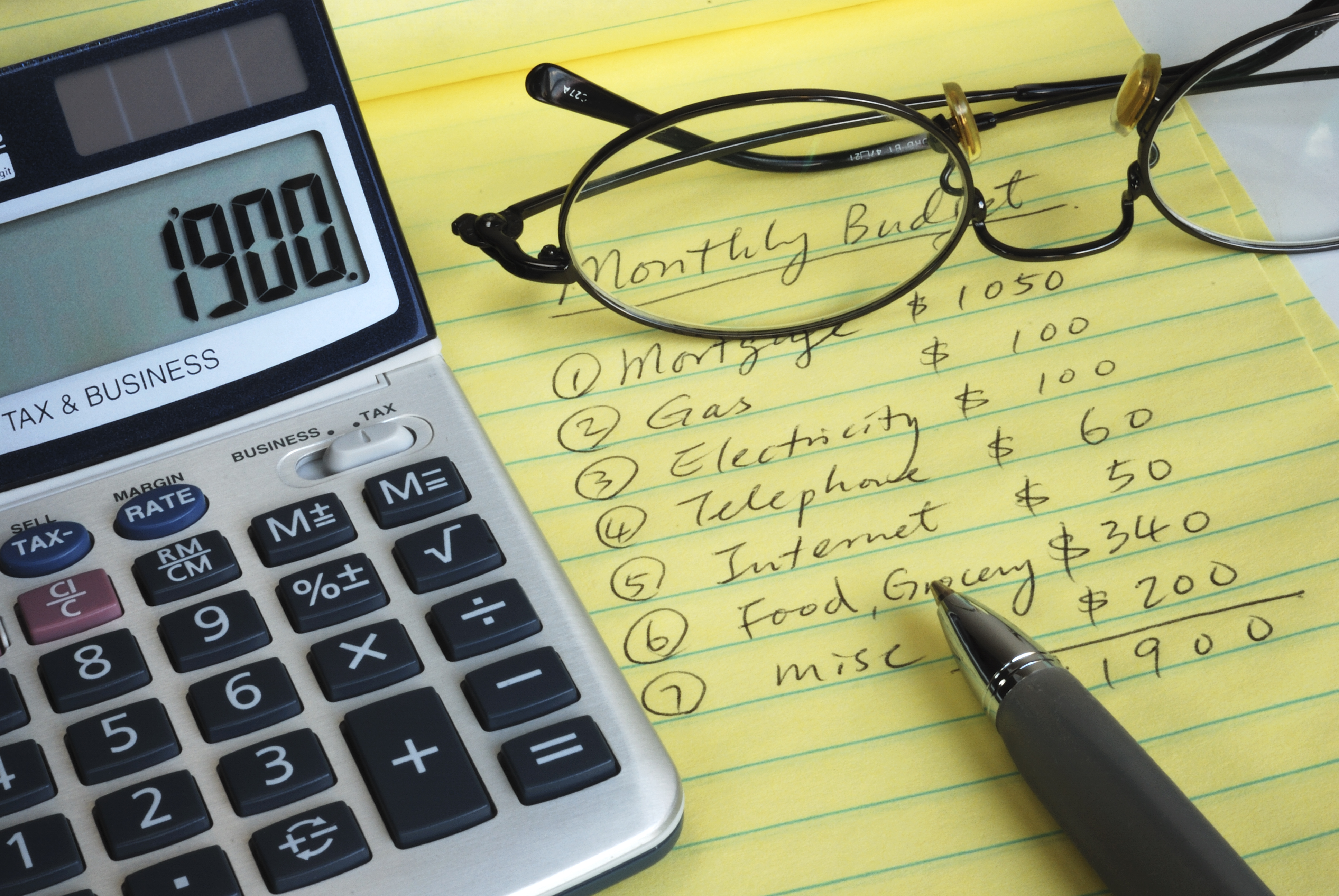

A budget is a listing of expenditures and revenue. It is the quantities of money that presently can be found going in and out each month/year. It is also the forecasted in as well as out amounts of each month/year.

A projected budget provides a framework for making decisions concerning expenses, such as terminating premium cable expenses or to save money for a brand new car. A budget allows you to monitor how close you are to your goals.

The budgeting process is created to be flexible; you must have an expectation that a budget plan will alter from month to month, and also will certainly need recurring monthly review. Expense overruns in one group of a budget must in the next month be made up or avoided. For instance, if you or your family spends $100 more than planned at the grocery stores, the following month’s spending plan must reflect a $100 increase in groceries but must also decrease by $100 in various other parts of their budget

Safety measures require to be considered if budgeting on uneven earnings (say tips). Budget plans with irregular income must maintain two things in mind: making sure you save extra in good months in case you fall behind in a bad month.

A budget plan needs to estimate your average (yearly) earnings. Spending, which will be reasonably consistent, needs to be preserved below that quantity. A budget must enable mistakes and so keeping costs to 5% or 10% below the projected income is a traditional approach. When done properly, your budget plan needs to finish any provided year with concerning 5% of their earnings left over. Certainly being traditional and also having greater than 5% is never a negative suggestion.

Establishing a cushion can be a difficult specifically when starting if you are in a low spot in your earning cycle, although this is exactly how most budget plans begin. In basic, individual and household budget plans that start out with expenditures that are 5% or 10% below your ordinary income and ought to slowly develop a cushion of savings that can be accessed when earnings are below average.

Below are ideas on how to produce an individual budget.

Budgeting ABC’s

Why a budget is so essential? It looks like developing a spending plan is simply a tiresome workout, specifically if you feel your finances are already in excellent working order. However you would certainly be surprised exactly how valuable a budget is. A spending plan can assist keep your spending on track and also discover concealed cash flow problems that might liberate even more money to place towards your other monetary objectives.

Exactly How to Create a Budget?

The hardest component of producing a budget plan is producing one. It’s like looking at a blank piece of paper when you need to write something, the primary step is the hardest component.

Tips for Budgeting Success

Once you’ve made the effort to produce a spending plan it’s time to follow it. You can have the very best of intentions of complying with a budget plan, yet after a couple of weeks or months you wander away from your strategy. Do not allow that happen to you. Here are a couple of fundamental pointers that will guarantee your budget is a success.

Overspending Breaks Your Spending Plan

The main reason to produce a budget is to keep your funds under control by keeping an eye on how much money you’re spending and where you are investing it. When you stray from your budget it’s typically since your spending excessive cash someplace you understand you should not. If you have a budget plan that tells you exactly just how much you’re supposed to spend, after that you don’t have an excuse to spend beyond your means? There are a number of reasons why we overspend, so when you comprehend what triggers overspending, you are a lot more conscious and also can put a stop to overspending as well as maintain your budget plan on track.

You Can Use Cash Money to Keep Costs Controlled

Swiping plastic has actually become too easy. With both credit cards as well as debit cards, we can be in and out with buying anything in a matter of seconds. This ease comes at a price. By utilizing plastic we can begin to lose track of how much money is actually being spent. 3 dollars here, 5 bucks there, it does not feel like much at the time of acquisition, yet if you aren’t cautious they can add up and also damage your budget plan. One very easy method to help keep your everyday costs under control is to make use of cash instead of your credit or debit cards. It may not be as fast, however it will help you visualize just how much money you’re in fact taking away from your investing.

The main reason to have a budget is to keep your financial resources under control by keeping track of exactly how much cash you’re spending as well as where you are spending it.